Here's what you need to know about the Canada Emergency Business Account

Canada Emergency Business Account (CEBA) COVID19 Mentor Works

Canada Emergency Business Account (CEBA) GHi Audit, Accounting, Tax

Established in 2020, CEBA provides eligible businesses with an interest-free loan of up to $60,000. The program is designed to help Canadian businesses manage operating costs and keep the business running, even when revenues were affected by the pandemic. Initially, the program offered loans of up to $40,000.

Expansion of the Canada Emergency Business Account (CEBA)

There are two main streams regarding eligibility for the Canada Emergency Business Account (CEBA) loan. The Payroll Stream. The Non-Deferrable Expense Stream. The Payroll Stream is designed specifically for businesses that reported employment income between Cdn.$20,000 and Cdn.$1,500,000 for the calendar year of 2019.

Canada Emergency Business Account KBH Chartered Professional Accountants

My Loan Has Been Assigned to the CEBA Program. If your CEBA Loan has entered collections and is no longer accessible through your financial institution, then your CEBA Loan may be classified as 'Assigned'. FAQs for assigned CEBA Loans can be found in this section.

Businesses required to pay back CEBA loans Delta Optimist

If you have questions about why your business didn't meet the eligibility criteria for the CEBA loan, please contact the CEBA Call Centre at 1-888-324-4201. The content below only applies to businesses whose loans were converted to a 3-year Government loan due on December 31, 2026. Below is a summary of the CEBA Government Loan program.

What is the Canada Emergency Business Account?

The Canadian Emergency Business Account (CEBA) program, as outlined by the Government of Canada, did not include any specific refinancing offerings. CEBA was designed as an interest-free loan program to provide immediate relief for small businesses and not-for-profits experiencing temporary revenue reductions.

Canada Emergency Business Account Update for NonBusiness Banking Account Holders Ontario

The Deputy Prime Minister and Minister of Finance, the Honourable Chrystia Freeland, is today announcing that the application deadline for the Canada Emergency Business Account (CEBA) is extended from 31 to October 31, 2020. The government is working closely with financial institutions to make the CEBA program available to those with qualifying.

COVID19 Canada Emergency Business Account loan rules eased KRP

Today, the Deputy Prime Minister and Minister of Finance, the Honourable Chrystia Freeland announced that as early as October 26, 2020, the Canada Emergency Business Account (CEBA) will be available to businesses that have been operating out of a non-business banking account.

How to Apply For Canada Emergency Business Account Through CIBC To Do Canada

Small- and medium-sized businesses are an integral engine of Canada's economy, and they employ about 64 per cent of Canadian workers. Entrepreneurs, local small business, start-ups, growing medium-sized businesses—everywhere in Canada, there are people with good ideas, ready to grow their businesses and create good jobs.

One in five restaurants in Canada at risk as CEBA deadline looms, say advocates

The Canada Emergency Business Account (CEBA) played a crucial role in supporting Canadian businesses through the economic uncertainty caused by the COVID-19 pandemic. CEBA originally offered interest-free loans of up to $40,000 for Canadian small businesses.

Canadian Chamber of Commerce joins calls for extension of CEBA repayment deadline Winnipeg

On September 14, 2023, the Prime Minister announced extended deadlines for Canada Emergency Business Account (CEBA) loan repayments, providing an additional year for term loan repayment, and additional flexibilities for loan holders looking to benefit from partial loan forgiveness of up to 33 per cent.. The CEBA program was available from.

The Canada Emergency Business Account (CEBA) interestfree loans of up to 40,000 Kerr Financial

Learn more about the Canada Emergency Business Account (CEBA) for Commercial businesses. The CEBA Application period for New $60,000 loans and $20,000 Expansions has now ended effective June 30th, 2021. Applications submitted prior to the June 30th deadline will be processed provided required documents are uploaded within the permitted time.

Tax Treatment of Canada Emergency Business Account (CEBA) Kenway Mack Slusarchuk Stewart LLP

If you are a qualifying commercial business banking client, and your organization's payroll expense in the 2019 calendar year was between $20,000 and $1,500,000, the Canada Emergency Business Account (CEBA) provides access to a $40,000 term loan: 0% interest until December 31, 2022. No principal payments until December 31, 2022.

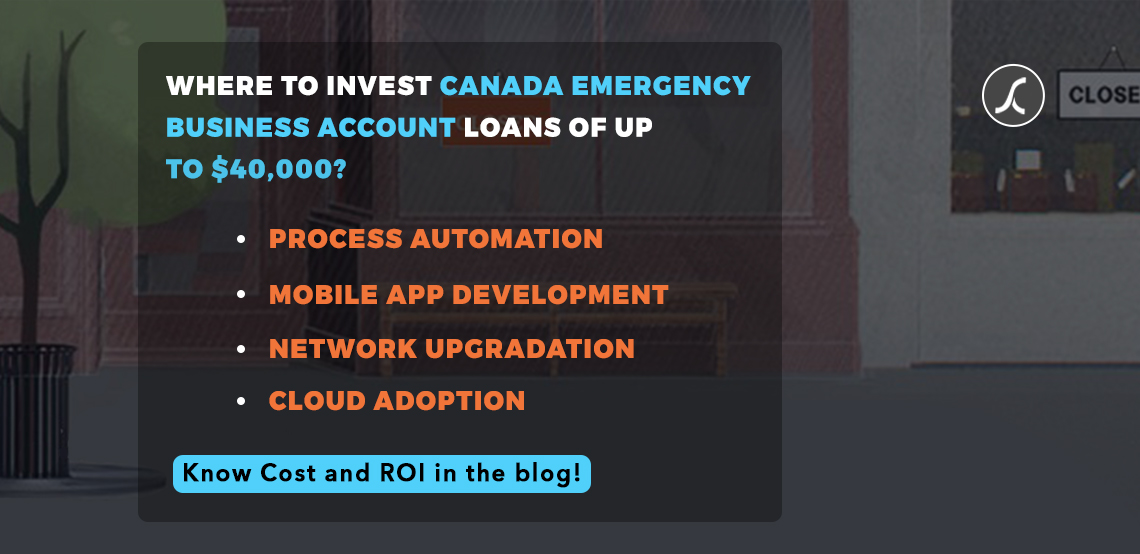

Canada Emergency Business Account 40,000 Investment Guide

What is CEBA: A Comprehensive Guide. The Canada Emergency Business Account (CEBA) is a government-backed initiative to offer financial assistance to Canadian businesses suffering the consequences of COVID-19. By providing interest-free loans and potential loan forgiveness, it intends to alleviate these economic hardships while ensuring.

COVID 19 BUSINESS SUPPORT CANADA EMERGENCY BUSINESS ACCOUNT REVIEW Ira SmithTrustee

Canada Emergency Business Account (CEBA) The CEBA repayment deadline has passed. The Jan 18, 2024 repayment deadline for the CEBA program has now passed. Starting Jan 19, 2024, all outstanding CEBA loans would start to accrue interest at a 5% annual rate, and are payable in-full by Dec 31, 2026.

Canada Emergency Business Account Program Bank Portals (CEBA) Mississauga Board of Trade

The Canada Emergency Business Account (CEBA) is an interest-free loan program with a maximum of $60,000 to help Canadian businesses impacted by COVID-19. Eligibility for the CEBA loan depends on income levels and the preparation of necessary documentation, including the 2019 T4 summary. Loan forgiveness up to 33% is available if repaid by.

.